49+ what debt to income ratio is good for a mortgage

Web What is a good debt-to-income ratio. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

Ad Compare Loans Calculate Payments - All Online.

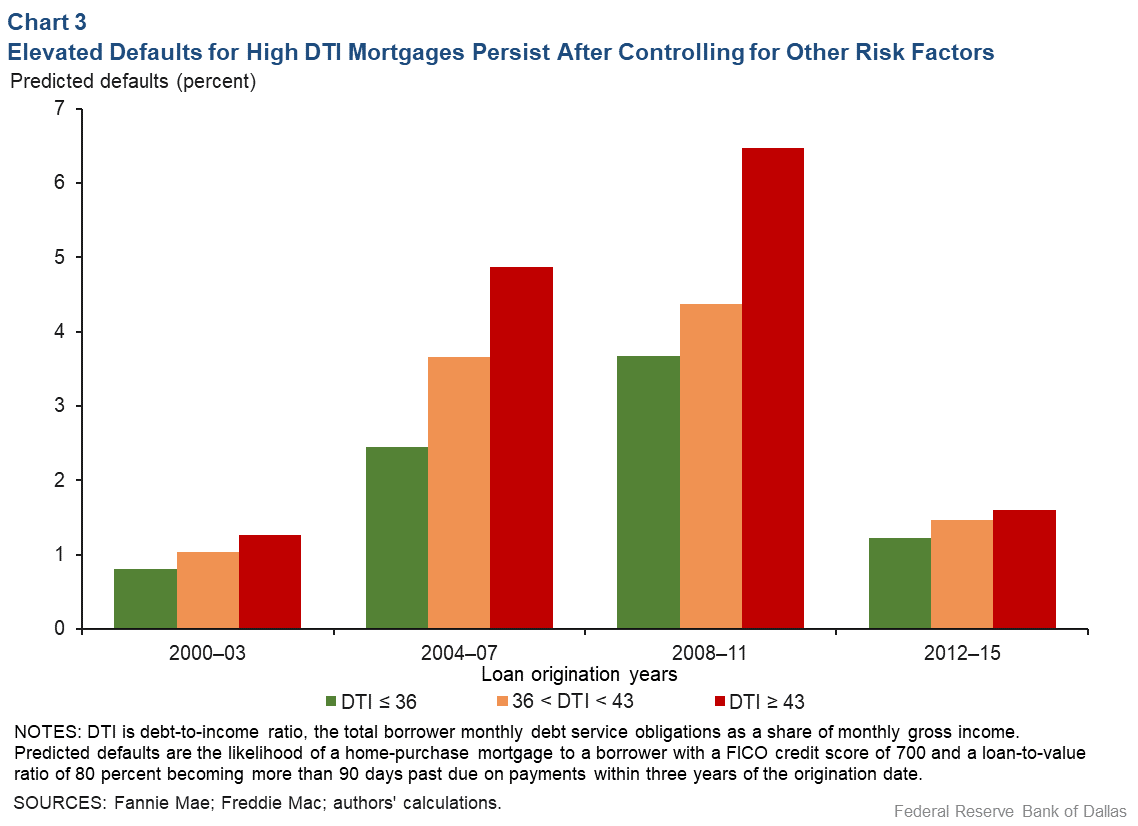

. Debt can be harder to manage if your DTI ratio falls between. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Apply Online To Enjoy A Service.

Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Check How Much Home Loan You Can Afford. Ad Compare Loans Calculate Payments - All Online.

Minimum 580 credit score. Web With at least 10 down your credit score can be a minimum of 500. Your monthly expenses include 1200.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Web 43 to 50.

But each mortgage lender can set its own eligibility requirements and DTI. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Check How Much Home Loan You Can Afford.

Web A general rule of thumb is to keep your overall debt-to-income ratio at or below 43. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web Generally a good debt-to-income ratiois around 36 or less and not higher than 43.

Web How to calculate your debt-to-income ratio. Web Debt-to-income ratio total monthly debt paymentsgross monthly income. 1 2 For example.

Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. Ratios falling in this range often show lenders that you have a lot of debt and may not be ready to take on a mortgage loan. This is seen as a wise target because its the maximum debt-to-income ratio at which youre.

Multiply that by 100 to get a. To put only 35 down youll need a credit score of at least 580. Ideally lenders prefer a debt-to-income ratio.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a. Highest Satisfaction for Mortgage Origination.

Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. You have a pretax income of 4500 per month.

Debt To Income Ratios Home Tips For Women

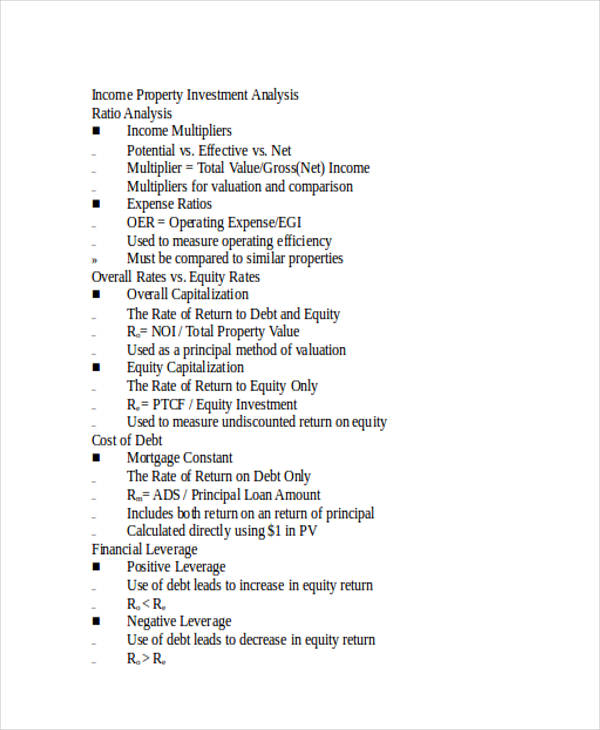

Analysis 49 Examples Format Pdf Examples

Exhibit991

Debt To Income Ratio Dti What It Is And How To Calculate It

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What Debt To Income Ratio Is Needed For A Mortgage Tally

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Dti Ratio What S Good And How To Calculate It

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What Is A Good Debt To Income Ratio Better Mortgage

:max_bytes(150000):strip_icc()/MortgageRates_whyframestudio-6aa583d504f34e758a2b63f052308838.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Business Succession Planning And Exit Strategies For The Closely Held

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

The Right Debt To Income Ratio You Need To Buy A House

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News